Will Office Recovery Influence the Broader CRE Market?

CRE Outlook Shaped by Evolving Inflation Pressures and Office Return

Inflation Bump Remains Modest… for Now

Headline inflation rose to 2.7%; core inflation ticked up to 2.9% in June

Tariff impacts are emerging in goods like appliances and electronics

Broader inflation effects are likely delayed while businesses sell their pre-tariff inventories

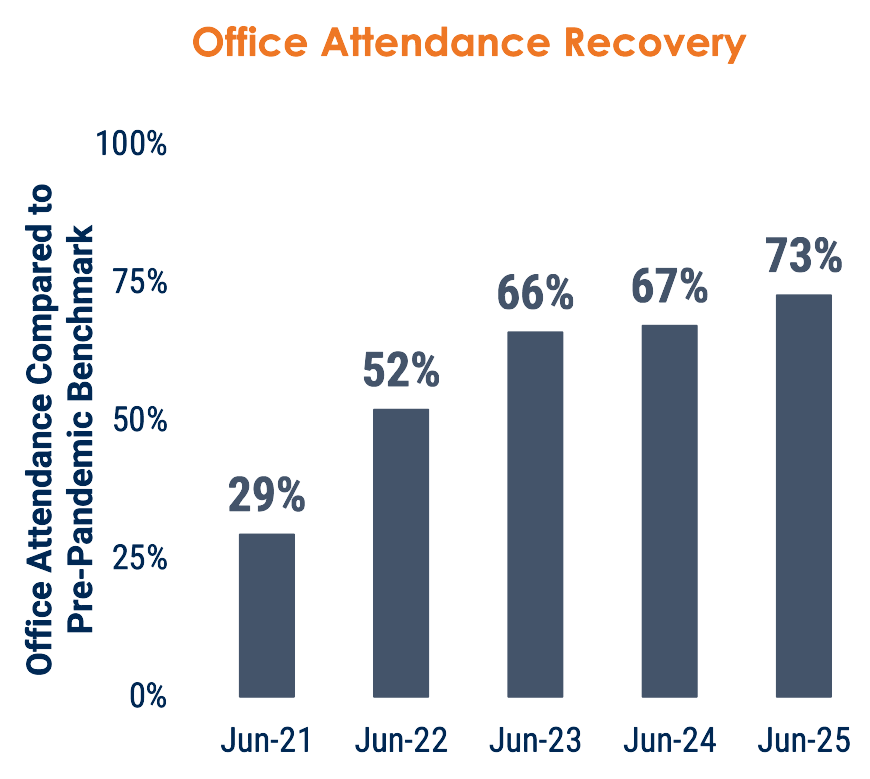

Office Attendance Trending Up, But Slowly

June office attendance rose to 72.6%, up from 29% in June 2021 (compared to June 2019 levels)

Office vacancy rates have trended lower since reaching their peak in the first half of last year

More companies are mandating in-office work

Return to Office Supports Broader CRE Demand

Office use influences housing and retail space demand

Local return-to-office momentum varies, but forward-looking investors may find value in the emerging trends

Office attendance share of June 2019 total

Sources: Marcus & Millichap Research Services, Placer.AI

Watch Video Below: