The Eye of the Storm? Interest Rates, Tariffs and Uncertainty

Tariffs, Taxes, and Treasuries:

CRE Navigates a Narrow Window of Clarity

Calm May – June Lull Could End Soon

10-year Treasury has sat in a 4¼ % – 4½ % band, drifting to the low end in recent weeks

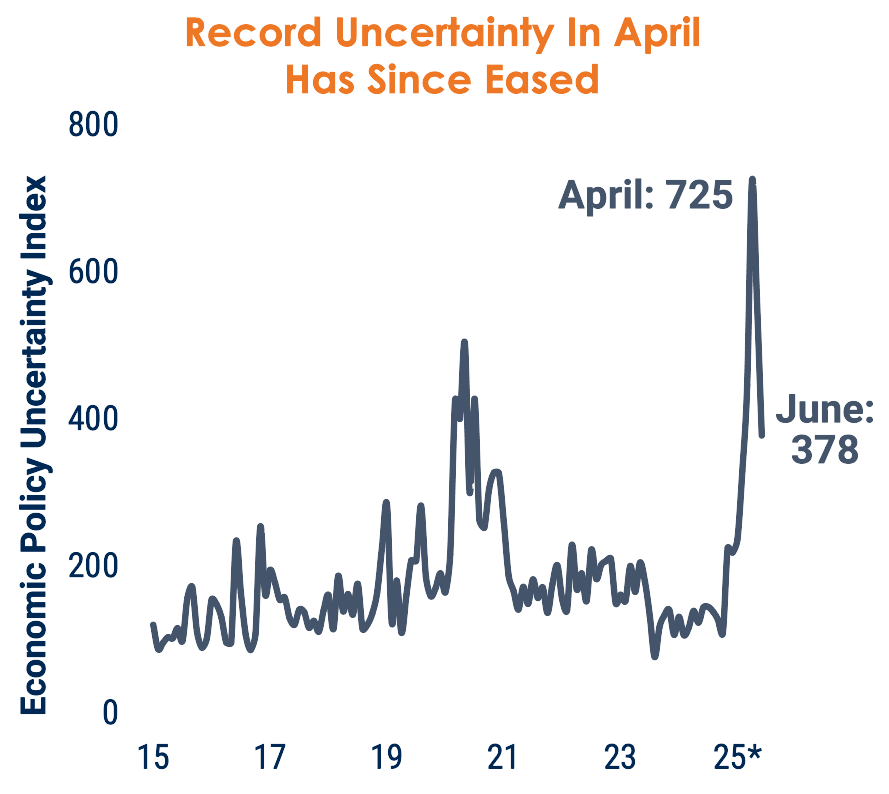

Uncertainty index plunged after April’s record spike as the 90-day tariff pause and solid data soothed nerves.

Pause expiry and tax-bill rollout in July–Aug. could send uncertainty climbing again.

Tariffs Stay High—and Could Pivot on Short Notice

Effective rates today: China 27.9%, Mexico 10.7%, Canada 11.2%, all others ≈11% (autos 25 %, steel/aluminum 50%)

90-day reprieve ends Jul 9; prior moves (e.g., Canada digital-tax reversal) show rates can change overnight

Any fresh shifts would quickly reignite market volatility and planning headaches for investors

New Tax Law Favors CRE but Adds Rate Pressure

CRE-friendly tax win: 100% bonus depreciation may boost first-year returns

Budget score adds about $3.3T deficit; Treasury plans $554B new debt in the next three months

Extra issuance, with the Fed and foreign holders trimming portfolios, risks nudging long-term rates higher—making “lock-in-now” financing attractive

*Through June

The Economic Policy Uncertainty Index is a measure of policy-related economic uncertainty, derived from the frequency of news articles discussing economic policy uncertainty in leading U.S. newspapers. Higher values indicate greater uncertainty.

Sources: Marcus & Millichap Research Services, Scott R. Baker, Nicholas Bloom, and Steven J. Davis.

Watch Video Below: