Durable Retail Sales Positive for CRE

Retail Sales Resilience Supports CRE Performance

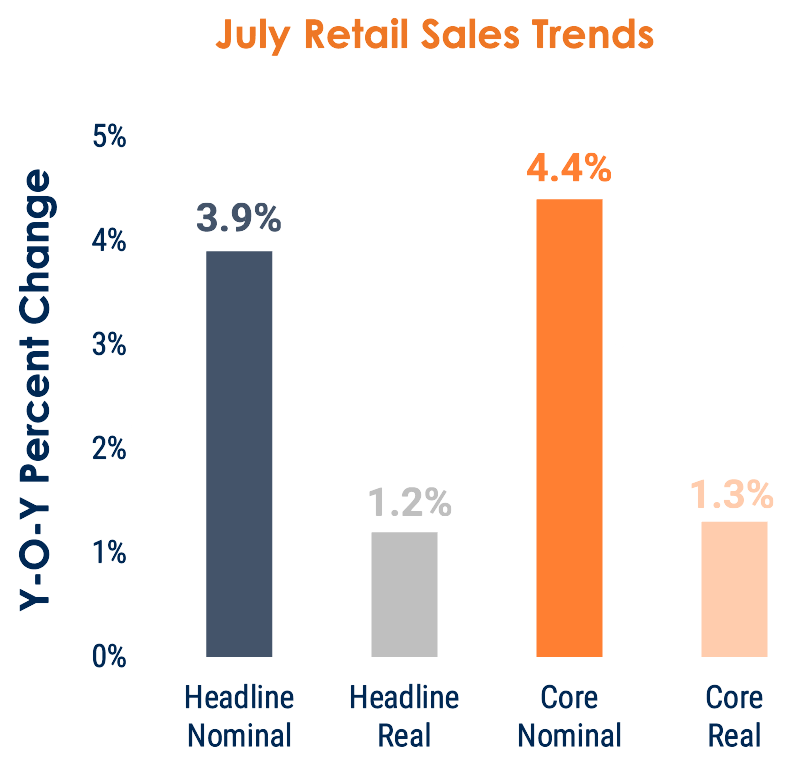

Retail Sales Remain Sound, But Real Growth is Minimal

Retail sales look stronger in nominal terms, but after adjusting for inflation, growth is modest

The retail sales outlook could be influenced by tariffs and the broader employment market

Debt Looks Alarming, But Consumers Aren’t Overextended

Credit card, auto, and mortgage debt are all at or near record highs, with total household debt reaching a record $18.4 trillion

But income has been rising, so debt levels as a percentage of income are generally at or below the long-term trend

Wages and Savings Cushion Spending — For Now

Wages grew 3.9% last year, outpacing inflation

Savings balances at $25.9T, up 4.3% YoY, just below 2021 peak

Consumer sentiment remains a wildcard – will consumers continue to spend or will they save more?

Adjusted for inflation using core CPI (July 2025 dollars); core retail sales exclude auto and gasoline sales

Sources: Marcus & Millichap Research Services, U.S. Census Bureau, BEA

Watch Video Below: